English

English

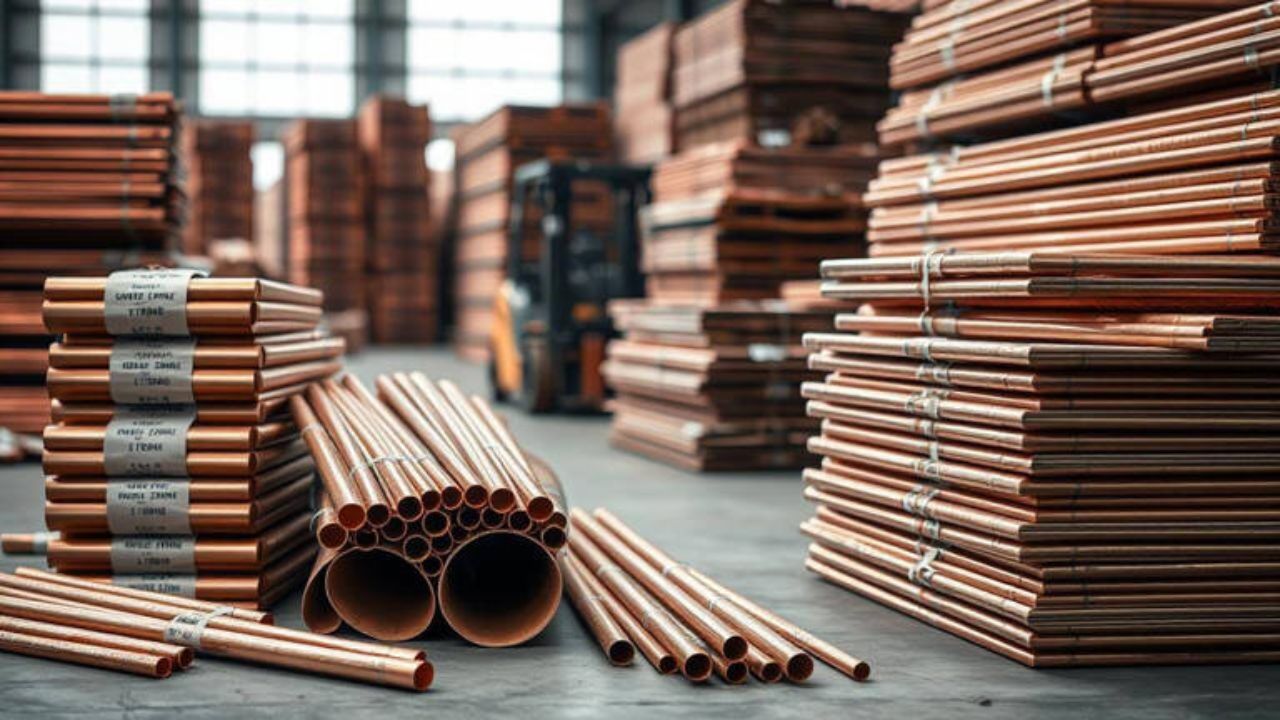

Copper has emerged as one of the best-performing commodities, delivering nearly 60 percent returns over the past year. Strong demand from electric vehicles, renewable energy, data centers, and the defense sector has driven prices sharply higher.

Global Copper Shortage Pushes Prices to New Peaks

New Delhi: Copper has surprised investors with impressive returns in 2025. Over the past year, copper prices have surged by nearly 60%. On January 6, 2026, the price of copper in the global market (COMEX) reached $6.09 per pound, compared to around $3.80 a year earlier. On January 9, the price fell slightly to $5.84, but the market is indicating that copper's luster will remain.

According to a report by Motilal Oswal Wealth Management, 2025 was a very strong year for copper. International prices reached close to $13,000 per tonne. This surge is not merely the result of speculation; rather, strong fundamentals underpin this growth, which could support prices in the future.

The world is rapidly moving towards electric vehicles (EVs) and digital infrastructure. EV batteries, charging networks, power cables, and data centers require significant copper. Increasing orders in the defense sector have also further strengthened copper demand. On December 29th, copper prices on India's MCX reached a record high of ₹1,392.95 per kg.

The market's simple principle is: high demand and low supply lead to higher prices. According to Ross Maxwell, an expert at VT Markets, the current surge indicates that global copper availability is declining. The recent purchase of approximately 600,000 tons of additional copper by the United States has further pressured the supply chain. The International Copper Study Group estimates that the world could face a copper shortage of approximately 150,000 tons by 2026.

Investing in copper in India isn't as easy as investing in gold or stocks. Currently, there are no copper ETFs or mutual funds available. The only option for retail investors is the MCX futures market, but a lot here is 2.5 tons, which requires significant investment and risk.

Investors who don't want to invest directly in commodities can keep an eye on copper-related companies in the stock market. Hindustan Copper Limited directly benefits from rising copper prices. Vedanta Limited and Hindalco Industries are also important companies in this sector. However, experts advise understanding the risks before investing, as the commodity market is highly dependent on global conditions.

No related posts found.