English

English

In Budget 2026, Finance Minister Nirmala Sitharaman proposed raising Securities Transaction Tax (STT) on futures from 0.02% to 0.05% and on options premium and exercise from 0.1%/0.125% to 0.15%. The move aims to curb excessive speculation in F&O segment and stabilize markets.

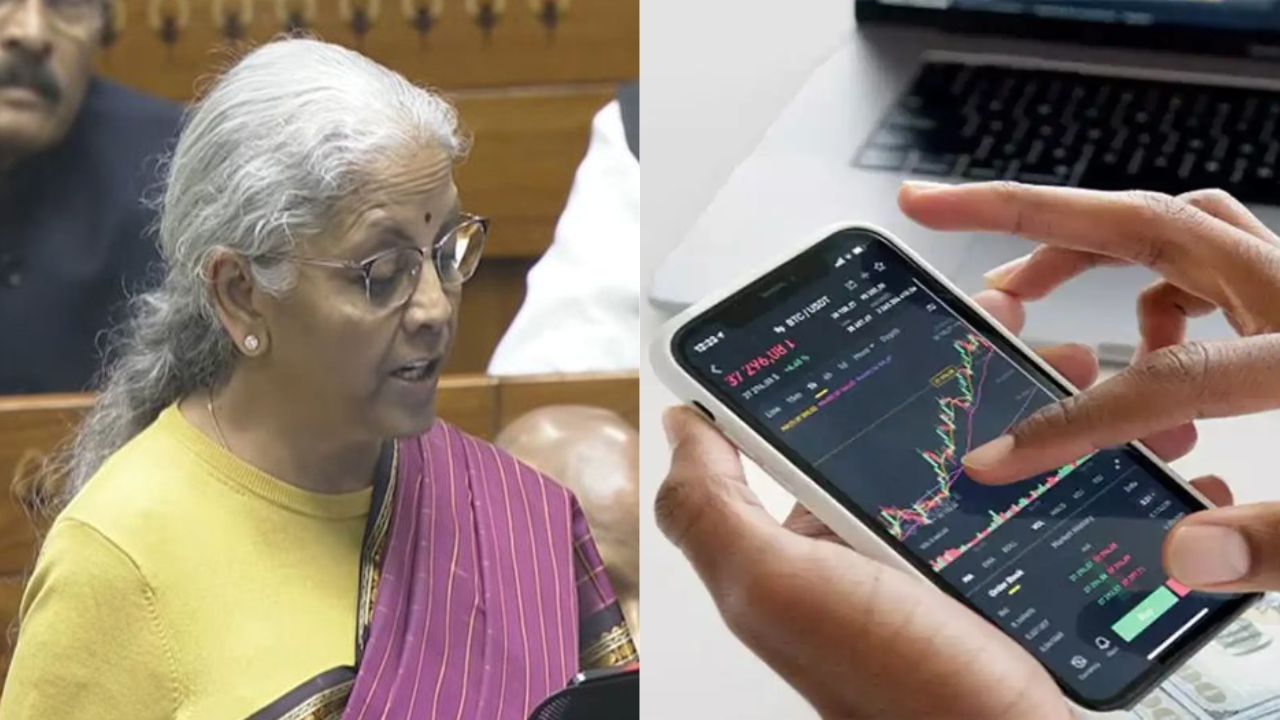

Finance Minister Nirmala Sitharaman Proposes Higher STT on F&O

New Delhi: Union Finance Minister Nirmala Sitharaman, while presenting the 2026-27 Budget in Parliament today on Sunday, proposed increasing the Securities Transaction Tax (STT) on futures and options (F&O). She stated that this step was necessary to reduce speculation in the derivatives segment and stabilize the market.

According to the budget, the STT on futures will be increased from 0.02% to 0.05%. The STT on options premiums has been increased from 0.1% to 0.15%, and on options exercise from 0.125% to 0.15%.

Nirmala Sitharaman stated, "This reform is aimed at appropriate course correction in the F&O segment and generating additional revenue for the government."

Budget 2026 is historic, strengthens India’s foundation with path-breaking reforms: PM Modi

The stock market reacted sharply to the proposal to increase the STT. Nifty fell nearly 400 points to below the 25,000 level. Traders and investors say that the continued increase in STT and capital gains tax is increasing transaction costs and making active trading less attractive.

STT and capital gains tax have also been increased in the past few budgets. STT on the sale of options was increased from 0.0625% to 0.1% and on futures from 0.0125% to 0.02%. LTCG tax was increased from 10% to 12.5%, and STCG from 15% to 20%.

This has made equity and derivatives trading less attractive, according to investors and brokerage firms.

India’s 2026 Budget Makes It Easier for Foreign Companies to Invest

The market has witnessed sharp fluctuations in the past, resulting in losses for ordinary investors. Excessive speculation in the futures and options segments impacts the entire market. The government's objective is to curb excessive speculation and bring stability to the market.

Securities Transaction Tax (STT) is levied on transactions made in the stock market. This includes equity shares, equity mutual funds, futures, and options. STT is mandatory on every transaction, whether profit or loss. STT was implemented in India on October 1, 2004. Its purpose was to replace the LTCG tax, prevent tax evasion, and facilitate collection.