English

English

The Union Budget 2026–27 explains the government’s plan for earning and spending money in the next financial year. It estimates total spending at Rs53.5 lakh crore and revenue at Rs44.04 lakh crore, showing clearly how money is raised through taxes and borrowings, and how it is spent on states’ share, interest payments, welfare schemes, defence and subsidies.

Finance Minister Nirmala Sitharaman addresses the Union Budget 2026–27 in Parliament

New Delhi: The Union Budget 2026–27, tabled by Finance Minister Nirmala Sitharaman on Sunday, outlines the government’s financial roadmap for the coming year.

The Budget estimates total expenditure at Rs53.5 lakh crore, while targeting gross revenue of Rs44.04 lakh crore in FY27.

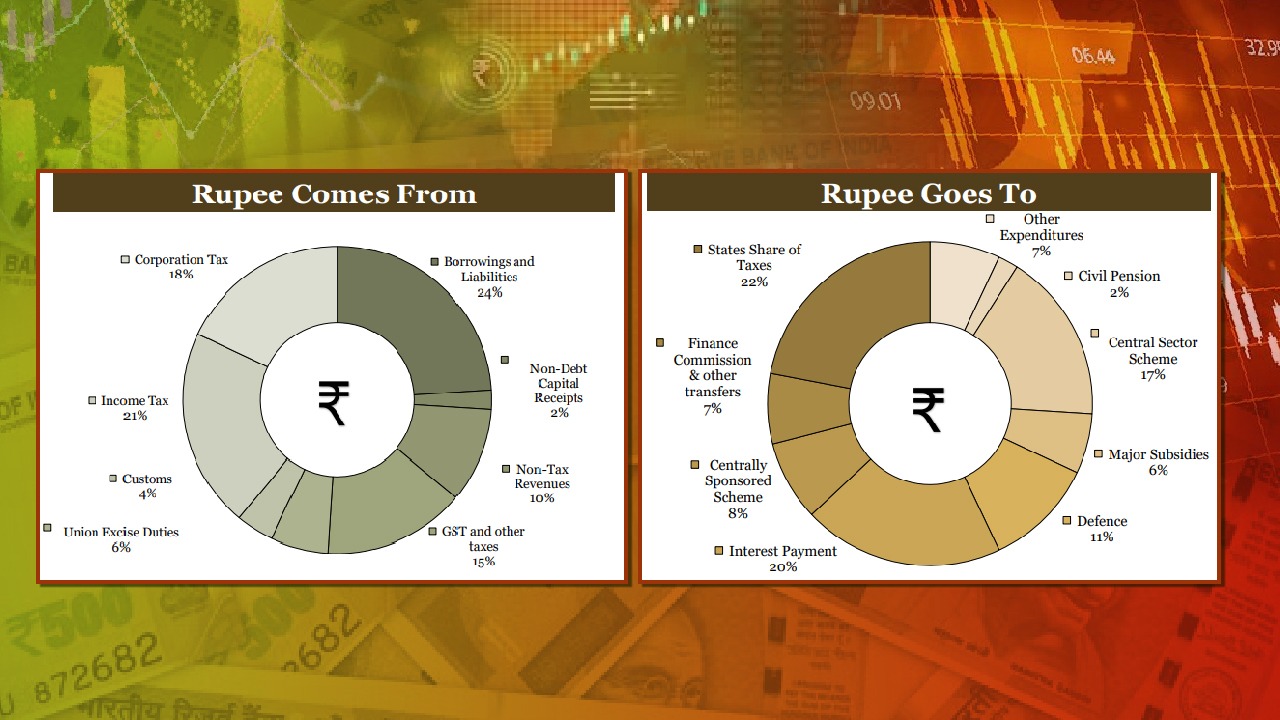

Budget documents provide a rupee-wise breakdown of how the Centre mobilises resources through various taxes and non-tax sources, and how these funds are allocated across key sectors.

Here is a simplified overview of where the money comes from and where it goes

Revenue Breakdown: How the govt earns funds

Borrowings and liabilities are the biggest source of revenue, making up 24% of the total collections.

This includes funds raised through market borrowings, treasury bills, and loans or bonds issued via the Reserve Bank of India, as well as borrowings from foreign governments and international institutions.

Income tax is the second-largest contributor, generating 21% of total revenue from individuals and businesses. This is followed by the Goods and Services Tax (GST), which is collected indirectly on the purchase of goods and services.

Non-tax revenue, comprising administrative charges, fines, penalties, interest income and dividends from public sector enterprises, contributes 10% to the overall revenue pool.

Among other sources, central excise duties account for 6%, while customs duties contribute 4%. Non-debt capital receipts, which include proceeds from asset monetisation and loan recoveries, make up the remaining 2%.

A rupee-by-rupee look at how Govt raises and spends money

Expenditure Pattern: Where the money is spent

On the spending side, the largest portion-22% of total expenditure-is transferred to states as their share of central taxes.

Interest payments on government borrowings form the second-highest expenditure, consuming 20% of the total outlay. Central sector schemes, which fund key national programmes, account for 17% of government spending.

Defence expenditure takes up 11%, reflecting continued focus on national security. Major subsidies, including food, fertiliser and fuel support, absorb 6% of the Budget.

Finally, civil pension payments account for 2% of total expenditure.