English

English

The US tariff decision has created an atmosphere of fear among Indian exporters, which has also affected the stock market. Foreign investors have started withdrawing capital while being cautious.

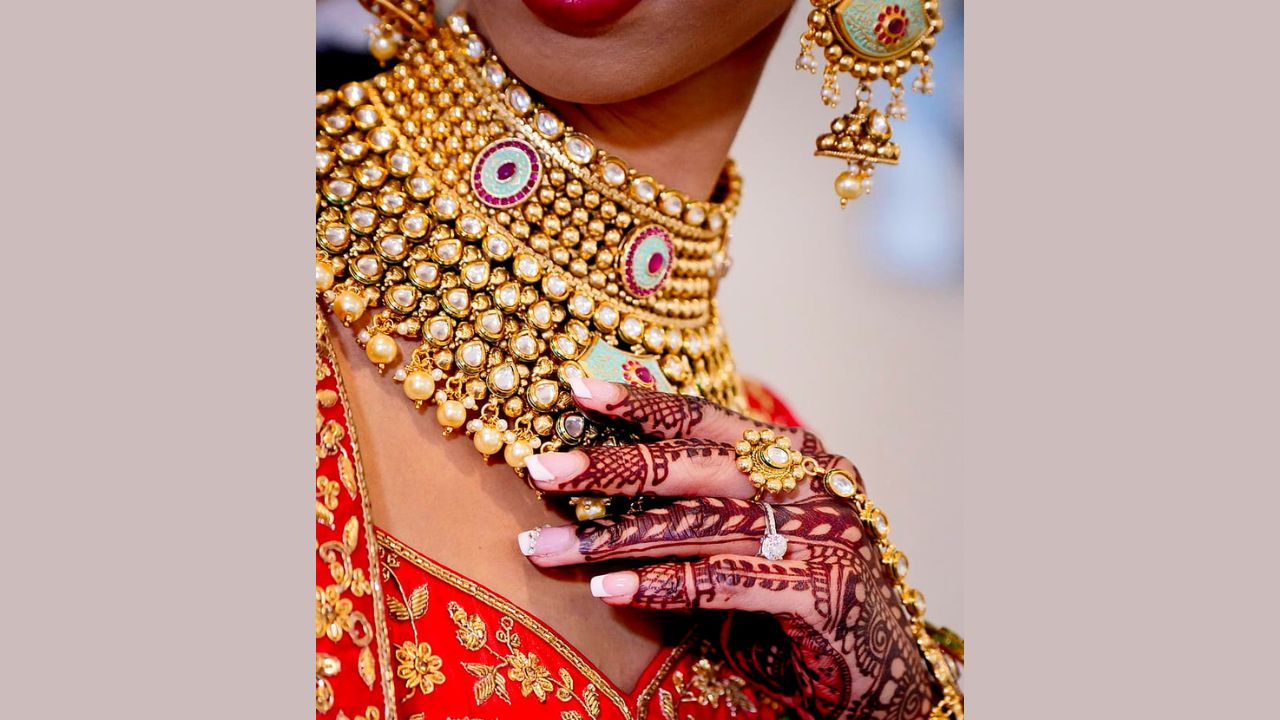

Gold Prices increase

New Delhi: After the US President Donald Trump imposed an additional 25 percent tariff on India, the Indian stock market is witnessing huge turmoil. The growing uncertainty among traders and exporters has completely changed the investment trend. In this unstable economic environment, investors have once again turned to gold. During early trade on Friday, 24 carat pure gold crossed Rs 1,02,000 per 10 grams, which is a new record so far.

Gold Price In Your City

Delhi

In the National Capital Delhi, 24 carat gold is being sold at Rs 1,02,710 and 22 carat gold at Rs 94,160 per 10 grams. In cities like Ahmedabad and Patna, it is at the level of Rs 1,02,610 (24 carats) and Rs 94,060 (22 carats) respectively.

Other Cities

In Mumbai, Kolkata, Bengaluru, Chennai and Hyderabad too, gold prices remain around Rs 1,02,560 (24 carats) and Rs 94,010 (22 carats) per 10 grams.

Stock Market Turmoil

The US tariff decision has created an atmosphere of fear among Indian exporters, which has also affected the stock market. Foreign investors have started withdrawing capital while being cautious. On the other hand, investors have turned to gold, a traditionally considered safe option, which has increased both its demand and price.

Repo Rate Unchanged

The Monetary Policy Committee (MPC) of the Reserve Bank of India has kept the repo rate stable at 5.5% in the August 2025 meeting, but this has not reduced the panic in the market. Experts believe that if instability persists in trade relations with the US, then further negative effects can be seen.

Gold And Silver Prices

The prices of gold and silver are decided on the basis of the dollar in the international market. The price of gold in India is directly affected by the fluctuations in the dollar-rupee exchange rate. Also, import duty, GST and other local taxes also affect the price. In the current circumstances, the rupee has weakened, which has further increased the price of gold.