English

English

As far as paying income tax, it feels good because it is an indicator of prosperity, and the taxpayer feels that our money is being used for the progress of the country.

New Delhi: As far as paying income tax, it feels good because it is an indicator of prosperity, and the taxpayer feels that our money is being used for the progress of the country. But sometimes this amount is being used for inducement to the voters by way of giving free stuff, various types of subsidies and remuneration to meet out the political obligation only, then it pinches a lot.

But income tax is an important legal provision, and we should follow it honestly. However, as far as possible within the scope of the law, we should make the effort to minimize the tax liability through good planning. Hope this article enlightens the facts to our readers in this regard.

In the case of salaried employees, tax is painful when it is not deducted on an equated monthly basis, particularly, when at year-end most parts of the salaries exhaust in a deduction for Income Tax. Thus, tax planning should start with the start of the financial year, and we should declare in advance to our employer about the expenses and investment and should adhere to the commitment by providing evidence of such expenses and investment when required by the management.

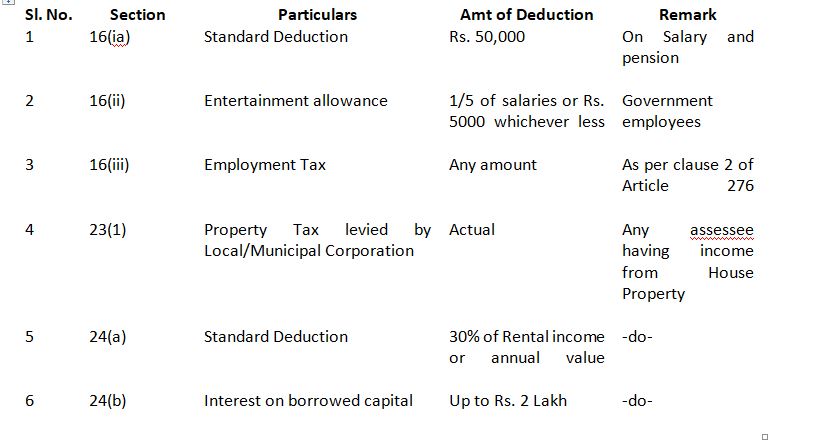

Apart from the salary, if the individuals have the income from any other source like income from house property, income from business or profession, capital gain, or the income from other sources, the details of such income, expenses, and investments are as under:

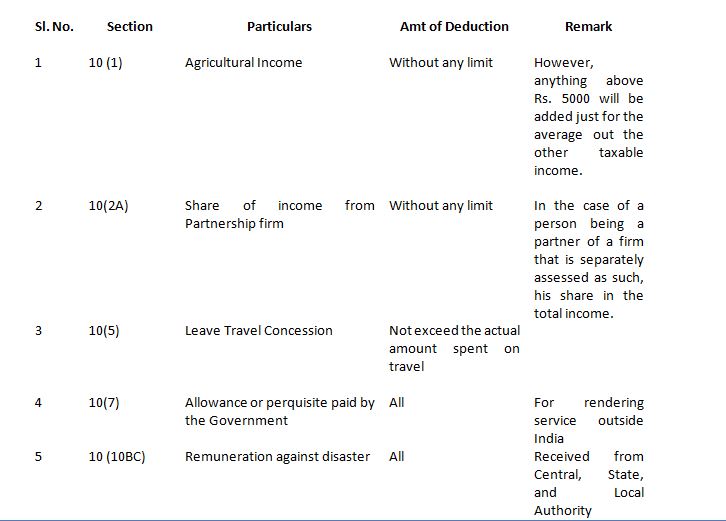

Part A: Incomes that do not form part of total income or are exempted from Income Tax and a few details are given below:

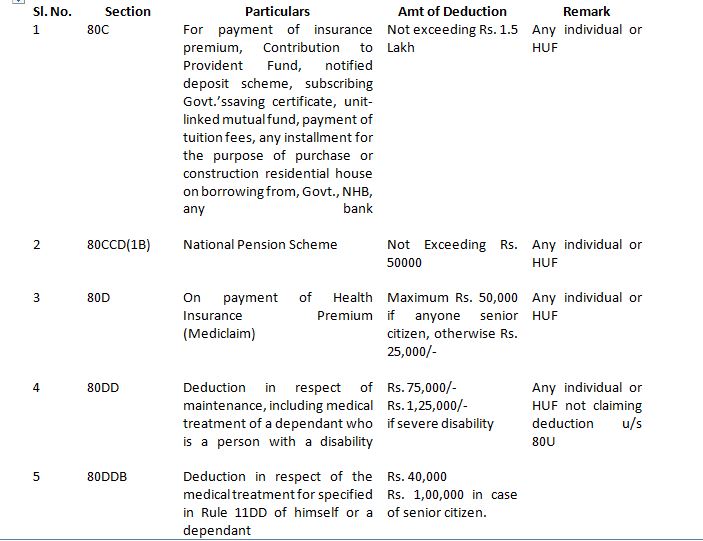

Part B: Some deductions to be made in computing total income:

Part C: Some other deductions allowed in computing total income:

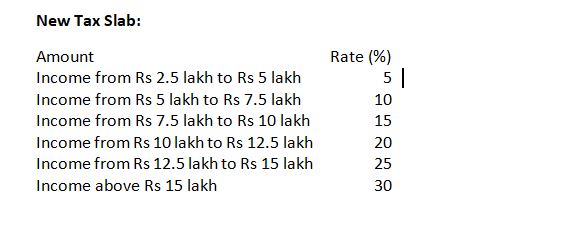

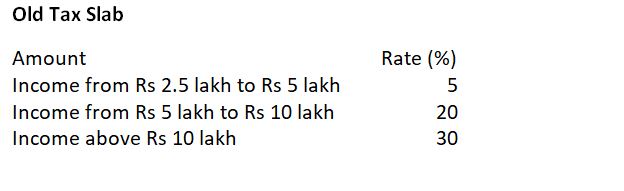

Further, there is new tax regime u/s 115BAC has been introduced in Budget 2020, which bifurcated the income tax slab. Both new and old slabs are as under:

However, the new regime of tax slab does not allow the deduction and certain exemptions

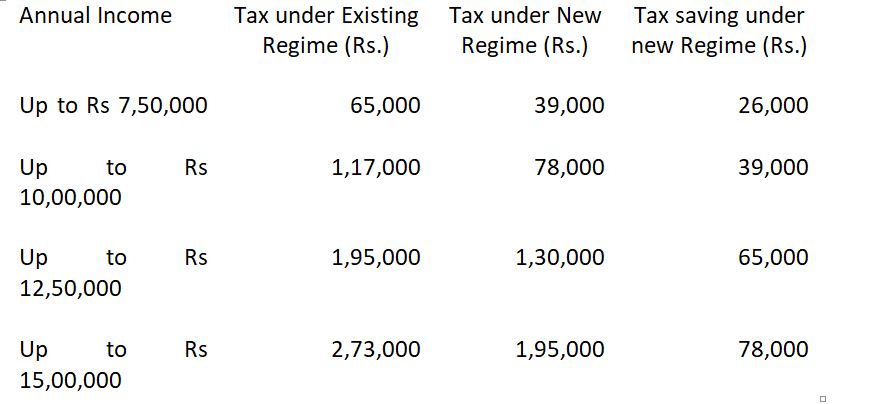

The tax payable under both the new and the existing regimes without claiming deductions and exemptions is as below:

Before opting for the regime, the taxpayer should decide the pros and cons of both the slab. If he has exhausted the investments and expenses limit, then it is beneficial to opt old tax slab.

For a salaried person, there is not much scope to save the tax. However, for a person who is in business, there are lots of deductions available u/s 30 to 42 of the Income Tax Act. Hence, we use to say the UdymeBasati Lakshmi, (Lakshmi resides in the enterprise).

Disclaimer: The author of this article is Shankar Mishra, a Chartered Accountant with more than 20 years of experience in the field of Direct & Indirect Taxes and Company Law Matters. (ANI)

No related posts found.