English

English

How did a seemingly official HDFC Bank email almost trick a CEO into losing over Rs 8 lakh? Learn how phishing emails operate, why they are dangerous, and the steps to safeguard your finances.

KitabKopy CEO Ashish Ranjan Maurya received a phishing email mimicking HDFC Bank.

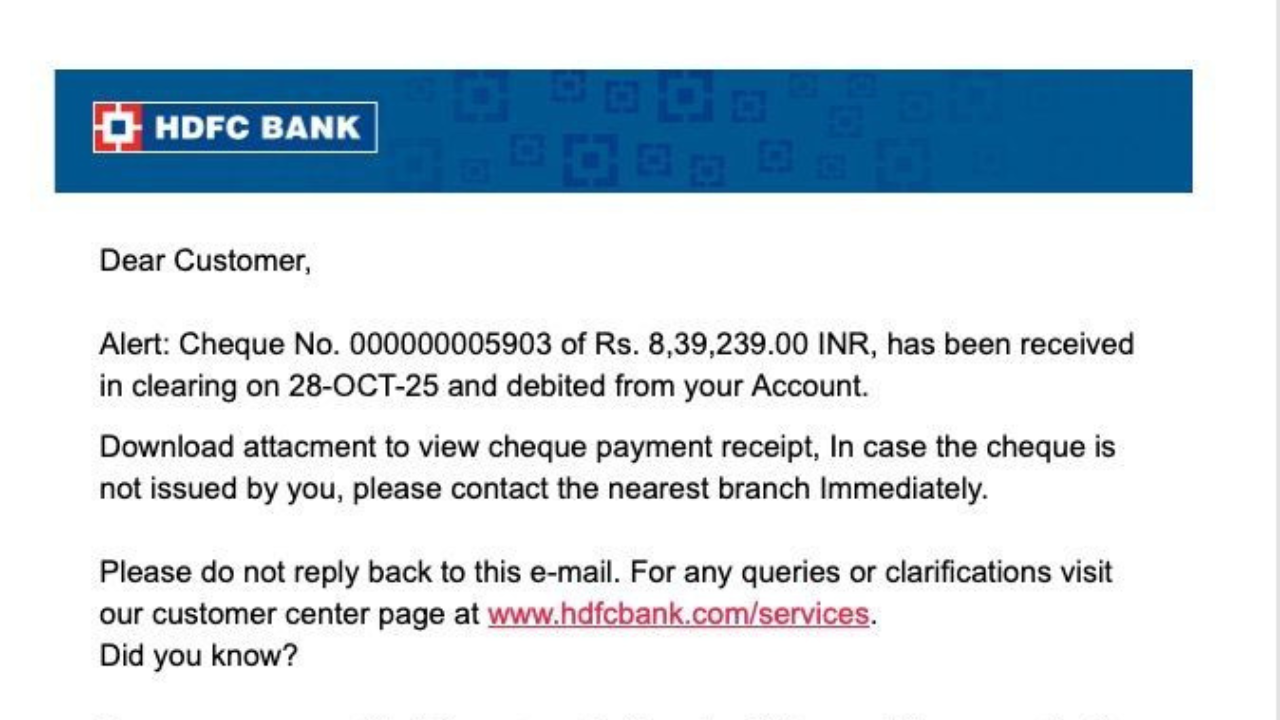

New Delhi: Ashish Ranjan Maurya, CEO of KitabKopy.com, shared his recent encounter with a highly convincing phishing email on LinkedIn. The email, which appeared to be an official communication from HDFC Bank, claimed that a cheque of Rs 8,39,239 had been cleared from his account. It even included an attachment labeled as a payment receipt, designed to make the scam appear authentic.

Maurya quickly noticed a subtle difference in the sender’s email address, info@hdfcbank-india.com rather than the official @hdfcbank.com domain, and realized the email was fraudulent. "Phishing Alert! Received an email that looked exactly like it was from HDFC Bank, same logo, same format, same professional tone," he wrote.

A phishing email is a deceptive message designed to trick recipients into revealing sensitive information, such as login credentials, OTPs, account numbers, or passwords. Fraudsters often use official logos, professional formatting, and convincing language to imitate legitimate companies, making it difficult for recipients to distinguish between real and fake communications.

Phishing emails can lead to significant financial loss, identity theft, and unauthorized access to personal accounts. Even small mistakes, such as clicking a malicious link or opening an infected attachment, can allow attackers to infiltrate bank accounts, steal confidential information, or install harmful malware on devices. In extreme cases, phishing scams have caused victims to lose lakhs of rupees or compromise sensitive business data.

From PIN Theft to Online Scams: Are you really safe from credit card frauds?

Email falsely claimed a cheque of Rs 8,39,239 had been cleared.

Experts recommend verifying the sender’s email domain carefully before interacting with any communication. Never share OTPs, passwords, or banking details via email or phone. It is advisable to avoid clicking on suspicious links or downloading unknown attachments. Banks and financial institutions encourage customers to report suspicious emails promptly and use official channels to verify account-related information. Enabling two-factor authentication and regularly updating passwords are additional safeguards.

Highlighting the growing sophistication of phishing attempts, Maurya tagged HDFC Bank in his LinkedIn post and requested guidance on verifying email authenticity. He urged both businesses and individuals to remain cautious and to double-check before opening attachments or clicking on links. "Let’s keep spreading awareness double-check before you click or download anything," he added. This incident reinforces the importance of digital vigilance in an era where online scams are increasingly targeting both personal and business accounts.

No related posts found.