English

English

Nvidia has achieved historic success by becoming the first public company with a market value of $4 trillion, surpassing giants like Apple and Microsoft. The inspirational story of hard work and struggle of its CEO Jenson Huang is the biggest reason behind this success.

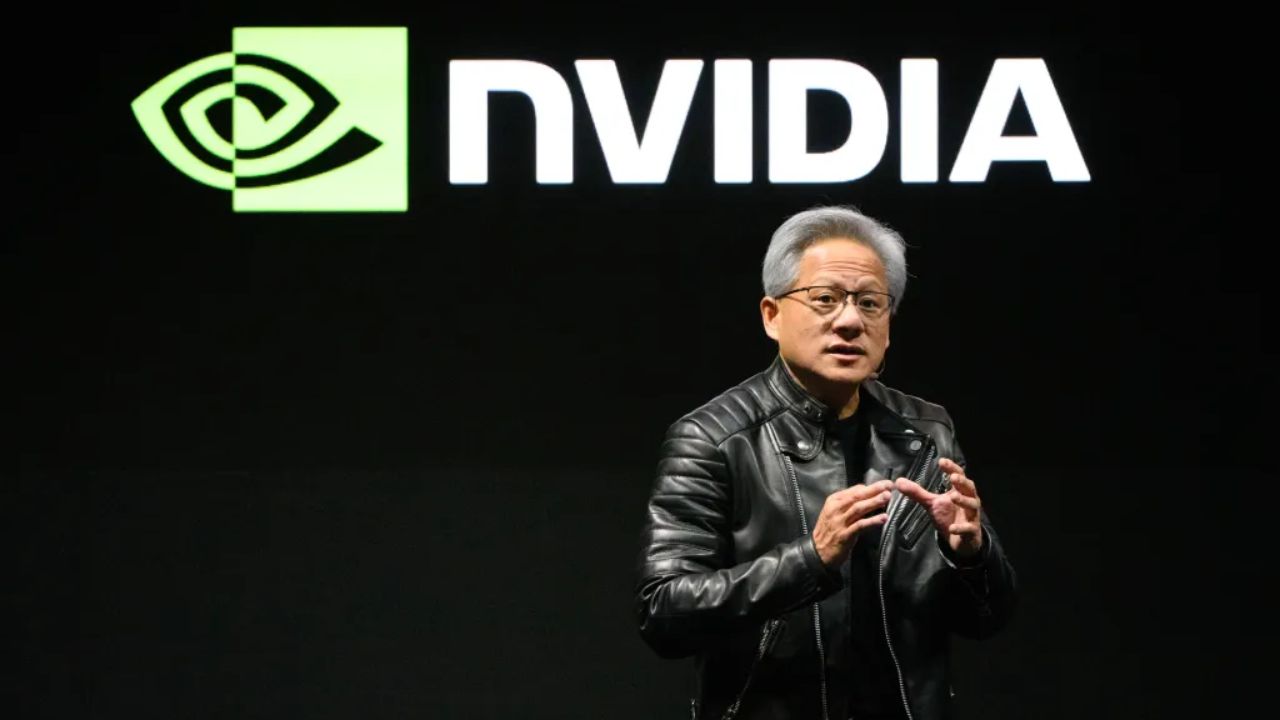

Nvidia (Image Source: Internet)

New Delhi: Nvidia, a company that makes generative AI and computing hardware, on Wednesday saw its shares rise by about 2.5 percent to reach a market cap of $4 trillion. This has made it the first public company in the world whose market cap has reached this huge level, reports Dynamite News correspondent.

In December last year, Apple surprised everyone by becoming the company with the largest market cap, but Nvidia has now grown rapidly and left it behind. Both Apple and Microsoft are already companies with a market cap of over $3 trillion.

Market value grew rapidly

Nvidia crossed the market cap of $1 trillion for the first time in June 2023. After this, in just one year, the company showed tremendous growth and crossed the $2 trillion mark in February 2024 and $3 trillion in June. Now in July 2025, it has reached $4 trillion.

During this period, the market value of Apple and Microsoft remained above $3 trillion, but Nvidia's growth was enough to leave them behind. Microsoft's market cap is now around $3.75 trillion.

CEO Jenson Huang's inspirational journey

Nvidia CEO Jenson Huang's story is as inspiring as his company's success. Born in Taiwan, Huang worked as a waiter, dishwasher, and busboy in Oregon, USA, in his early life. His struggle and hard work make him one of the top billionaires in the world today.

His wealth is currently around $140 billion, and he is the 10th richest person in the world, according to the Bloomberg Billionaires Index. Huang founded Nvidia at the age of 30, and today the company has become a leader in the field of AI technology.

A journey from 1 trillion to 4 trillion in two years

In June 2023, Nvidia crossed the market value of $1 trillion for the first time. Since then, the company's growth has been very fast. In February 2024, it touched $2 trillion, in June 3 trillion, and now in July 4 trillion.

Huge increase in financial performance too

Nvidia's first-quarter profit reached $44.1 billion, up 69 percent from last year. The company has projected a profit of $45 billion for the second quarter. Its quarterly results will be announced on August 27.

Effect of geopolitical tensions and trade deals

In April this year, Trump's tariff policy brought uncertainty to the market amid geopolitical tensions in the world, but after that Nvidia's shares have gained a tremendous 74 percent. New trade agreements between the US and other countries further lifted the company's stock.

Nvidia's dominance in the S&P 500 index

Nvidia has become the first stock on the S&P 500 index whose stock registered a gain of 7.3 percent on Wednesday. While Apple and Microsoft shares rose by 6 to 7 percent.