English

English

The Reserve Bank of India has proposed compensating customers up to ₹25,000 for losses from small-value fraudulent digital transactions, alongside new draft guidelines on mis-selling, loan recovery practices, and liability in unauthorized banking transactions.

Strong Growth Outlook as RBI Holds Rates Steady

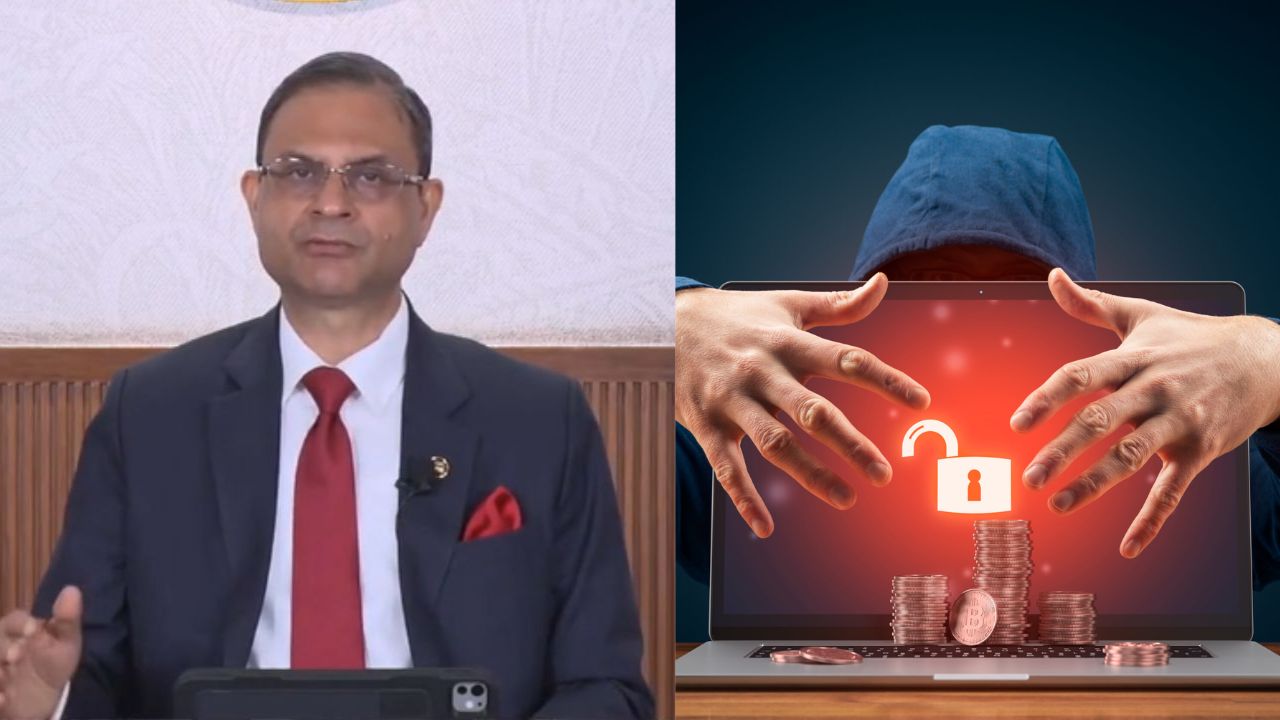

New Delhi: The Reserve Bank of India (RBI) has proposed a framework to compensate customers up to ₹25,000 for small-value fraudulent digital transactions, aiming to strengthen the security of digital payments. RBI Governor Sanjay Malhotra stated that this step is being taken to enhance customer safety and trust.

The RBI will issue three draft guidelines to strengthen customer protection. These will include provisions such as controls on mis-selling, regulations for loan recovery agents and recovery procedures, and limiting customer liability for unauthorized electronic banking transactions. These measures aim to make banking services more transparent and secure.

RBI keeps policy interest rates unchanged at 5.25%, maintains neutral stance; Full details here

The RBI will also release a discussion paper to further secure digital payments. Possible measures could include additional authentication for special categories such as those with lagging credit and senior citizens. This is expected to help reduce the risk of online fraud.

The Monetary Policy Committee (MPC), as expected, has kept the repo rate unchanged at 5.25%. This decision was taken in light of strong economic growth and some easing global conditions. The RBI has cut a total of 125 basis points since February 2025, which is considered the most aggressive easing since 2019. The previous meeting followed a 25 basis point cut in December.

The Indian economy is projected to grow at 7.4% in the current fiscal year. The government's economic advisor has projected a growth rate between 6.8% and 7.2% for the next fiscal year. This indicates that the domestic economy remains strong despite global uncertainties.

Indian Markets start lower as investors await RBI policy decision; Full details

Experts believe that the proposal for compensation in digital transactions and new customer protection regulations will boost confidence in the banking system. Furthermore, the stable repo rate clearly demonstrates an effort to maintain a balance between inflation and growth.

Overall, the RBI's latest decisions reflect a balanced approach on all three fronts: customer protection, strengthening digital payments, and stable economic growth.