English

English

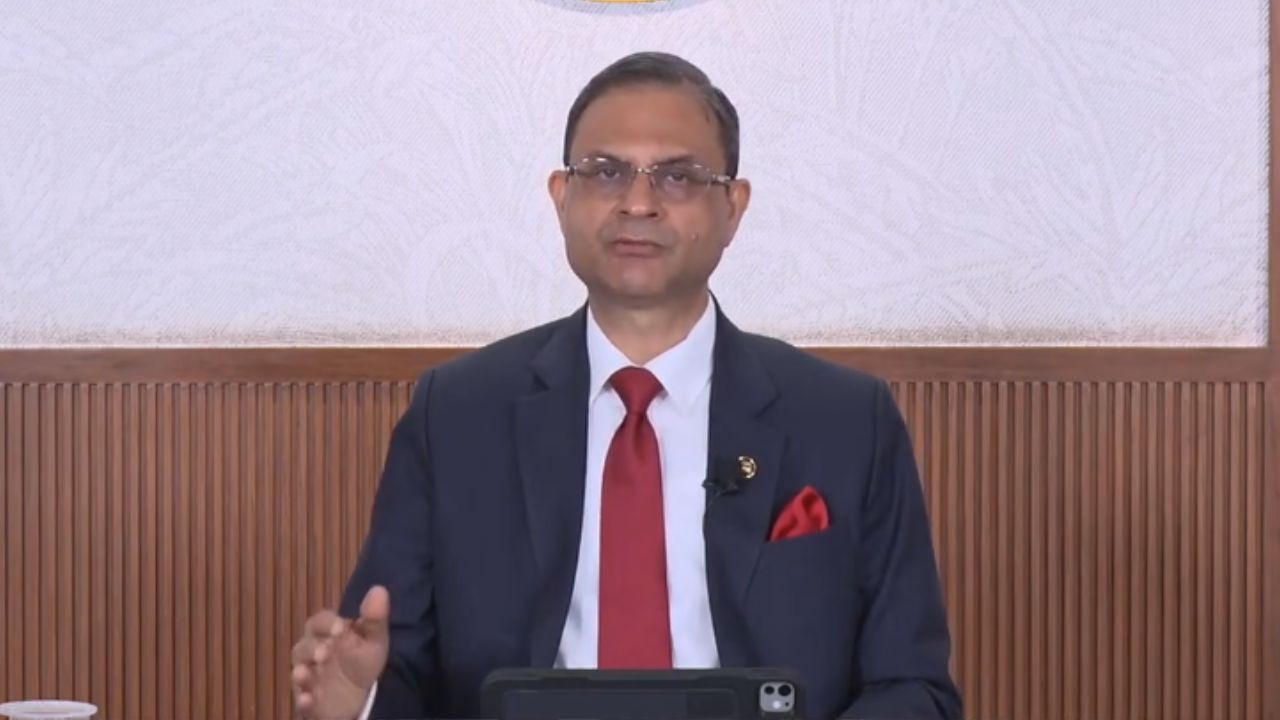

The Reserve Bank of India (RBI) has kept the repo rate unchanged at 5.25%, maintaining a neutral monetary policy stance. The decision was taken unanimously by the RBI Monetary Policy Committee (MPC) under Governor Sanjay Malhotra.

Repo Rate Steady at 5.25%, RBI MPC Holds Policy Neutral

New Delhi: The Reserve Bank of India (RBI) decided to keep the repo rate unchanged at 5.25% at its Monetary Policy Committee (MPC) meeting on Friday. The bank also announced a neutral monetary policy stance.

In a meeting chaired by RBI Governor Sanjay Malhotra, all members agreed to keep the repo rate unchanged. This move aims to maintain a balance between inflation and economic growth.

With no change in the repo rate, loan EMIs are likely to remain stable for the time being, and interest rates will remain unchanged. For depositors, FD and savings account rates are also not expected to see major changes in the near future. Overall, the immediate impact on both will be limited.

RBI cuts repo rate by 25 bps to 5.25%; Markets expect cheaper credit

The repo rate is the interest rate at which the Reserve Bank of India (RBI) lends money to commercial banks for a short period. A rise in the repo rate can make loans more expensive and EMIs higher, while a fall in the repo rate can make loans cheaper, boosting economic activity.

Under consumer protection, the RBI will introduce guidelines related to mis-selling, regulations for loan recovery agents, and limiting customer liability for unauthorized digital transactions. A framework for compensation of up to ₹25,000 to customers in small fraud cases is also proposed.

The collateral-free MSME loan limit has been proposed to be increased from ₹10 lakh to ₹20 lakh, providing easier access to credit for small businesses.

Big relief for RBI, PSGICs and NABARD employees as Centre approves wage, pension revision

CPI inflation remained low in November-December, with a slight increase due to a slowdown in food prices. Core inflation, excluding gold, remained stable at around 2.6% in December. Food supplies are expected to remain strong due to a good harvest, adequate reserves, and favorable sowing. However, risks remain from precious metals, energy prices, weather, and global uncertainties.

According to the RBI, CPI inflation is projected to be 2.1% in 2025-26 and 3.2% in the fourth quarter, while it could reach 4% and 4.2%, respectively, in the first two quarters of 2026-27.

Geopolitical tensions and escalating trade conflicts are impacting the global economic system. Inflation remains above target in many advanced economies, leading different central banks to adopt different policy stances.