English

English

PhonePe launches PhonePe Protect, a new feature using DoT’s FRI database to alert or block high-risk transactions, safeguarding users from online fraud and promoting safe digital payments.

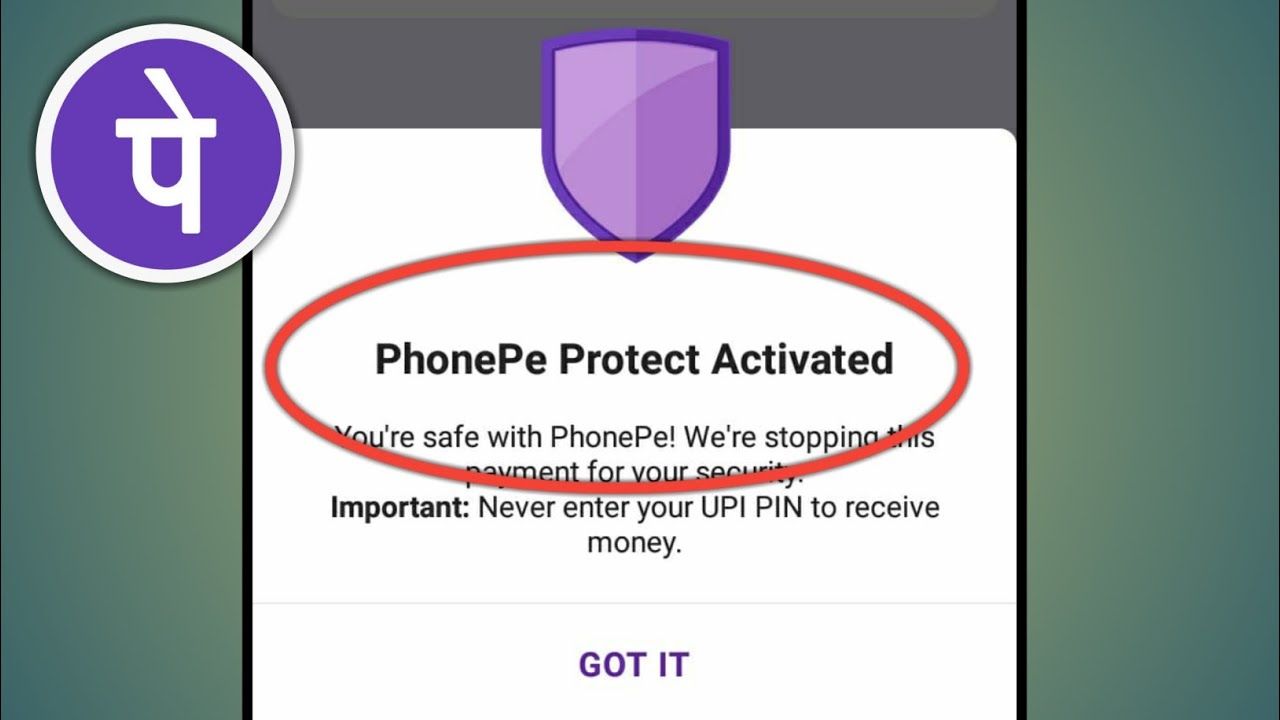

Now Safeguard Your Money With PhonePe Protect

New Delhi: The use of digital payments has increased rapidly, but with it, the risk of online fraud has also grown. Keeping this challenge in mind, PhonePe has launched a new feature, PhonePe Protect. Its aim is to warn users or prevent transfers before they send money to the wrong number, thereby reducing instances of online fraud.

PhonePe Protect is based on the Department of Telecommunications (DoT)'s Financial Fraud Risk Indicator (FRI) data. The app checks the number against the DoT database when a user is sending money.

If the number falls into the “Very High FRI” category, the transaction is automatically blocked, and a message appears on the screen: “PhonePe Protect Transaction Blocked”.

If the number is at a “Medium FRI” level, the user is warned: “This number has previously been associated with fraud, do you wish to proceed?” The user can then proceed at their own discretion.

In this way, the app also clearly explains the reason for blocking the transfer so that the user understands why the payment was stopped.

UPI transactions are increasing rapidly in India, but the risk of fraud has also increased proportionally. Previously, users would accidentally send money to fraudulent numbers because they were unaware that the number had been used in fraudulent activities. PhonePe Protect addresses this gap.

This feature is not limited to technology alone; it also serves as a tool for user education. When users are aware of the risk, they make more informed decisions before transferring money. In a network of over 610 million users, this feature adds a new layer of security.

How do PhonePe, Google Pay, and Paytm earn thousands of crores even after providing free services?

PhonePe Protect takes digital payment security to a new level. It's not just about technical security, but also a crucial tool for educating users and protecting them from fraud.

No related posts found.