English

English

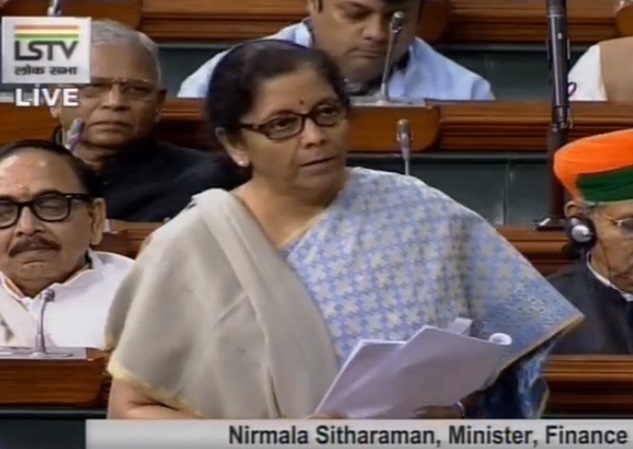

Finance Minister Nirmala Sitharaman said on Monday that the government’s move to reduce corporate tax has had a “positive impact” and companies wanted to get out of China due to trade war with the US.

New Delhi: Finance Minister Nirmala Sitharaman said on Monday that the government's move to reduce corporate tax has had a "positive impact" and companies wanted to get out of China due to trade war with the US.

Moving the Taxation Laws (Amendment) Bill, 2019 for passage in Lok Sabha, Sitharaman said the additional fiscal measures were taken to stimulate growth and boost job growth. The bill seeks to replace ordinance by the government.

Also Read: Cabinet extends term of 15th Finance Commission

She said many countries in South East Asia had reduced their corporate tax to attract investment and cited examples of Thailand, Vietnam and Singapore.

She said due to trade war with the US, there were indications that many multi-national companies wanted to get out of China.

The bill provides for inserting a new provision in the Income Tax Act and says that a company may opt to pay tax at 22 per cent if does not claim any incentive or deduction.

The bill seeks to replace an ordinance brought by the government earlier.

Also Read: Vistara, SBI launch co-branded credit card

She said a new provision in the IT Act from this fiscal provides an existing domestic company may opt to pay tax at 22 per cent plus surcharge at 10 per and cess at 4 per cent if it does not claim any incentive.

The effective tax rate for these companies comes to 25.17per cent for these companies.

Also Read: SBI Q2 profit surges six-fold to Rs 3,375 crore

They would also not be subjected to Minimum Alternate Tax (MAT).

The ordinance provided that a domestic manufacturing company set up on or after October 1, 2019, and which commences manufacturing by March 31, 2023, may opt to pay tax at 15 per cent plus surcharge at 10 per cent and cess at 4 per cent if it does not claim any deduction. The effective rate of tax comes to 17.16 per cent for these companies. They would also not be subjected to MAT. (ANI)