English

English

A CDS report reveals India’s electronics manufacturing surge—mobile exports grew from $0.2B to $24.1B (2018-2025) with 17L+ jobs created. PLI scheme & global supply chain integration key to rivaling China & Vietnam. Policy reforms urged to sustain growth

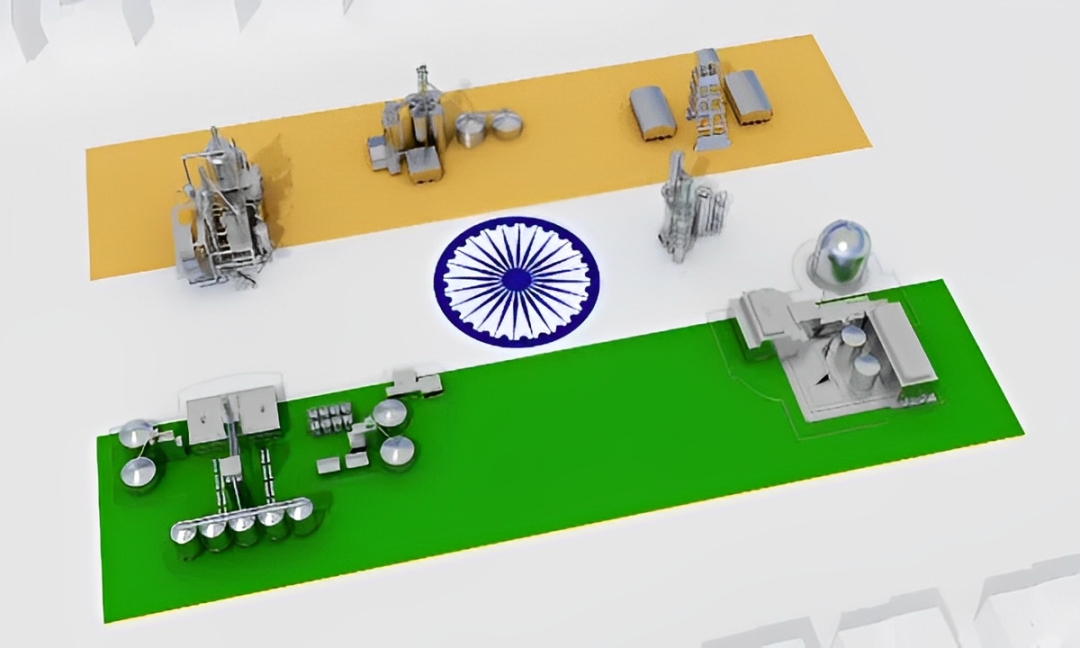

India Set to Overtake China as World's Electronics Factory (Image Source: Internet)

New Delhi: According to a new report, India may soon play an important role in the global electronics manufacturing sector and can become a global hub for electronics manufacturing like China. The report has been published by the Centre for Development Studies (CDS), and it states that if India joins backwards in the global supply chain (Global Value Chains—GVC) through "backward integration," it can challenge the dominance of countries like China and Vietnam.

What is Bacward Integration?

Backward Integration is a business strategy in which a company moves up the supply chain and starts doing the work that was previously done by another company. This means that the company starts controlling the supply of its raw materials or initial resources. This gives the company more control over the production process, which reduces costs and can improve quality.

For example: Suppose a clothing manufacturing company used to buy fabric from another supplier earlier. But now it starts making the fabric itself, so that it does not have to depend on external suppliers. This is called backward integration.

Highlights of the report

The report believes that the Production Linked Incentive (PLI) scheme, which was launched in 2020, is a major reason for India's progress in this direction. Due to the PLI scheme and India's participation in global value chains, India has emerged from an import-dependent mobile market in 2014-15 to a major production and export hub.

Tremendous increase in mobile exports

India's mobile phone exports have seen unprecedented growth. Exports are projected to grow from $0.2 billion in 2017-18 to $24.1 billion in 2024-25. This represents a historic growth of nearly 11,950%.

Domestic Value Addition (DVA)

Domestic contribution to the mobile manufacturing sector has also grown rapidly. Total DVA reached 23% in 2022-23, exceeding $10 billion. Direct DVA (directly from manufacturers) grew 283% from $1.2 billion to $4.6 billion. Indirect DVA (contribution from domestic suppliers) grew 604% from $470 million to $3.3 billion.

Huge jump in employment

According to the data of the Annual Survey of Industries (ASI), the mobile sector provided more than 17 lakh jobs in 2022-23. Jobs related to exports alone increased 33 times, and the salary increase associated with them was also remarkable.

Experts' opinion

CDS Director Prof. C. Veeramani believes that the success of mobile manufacturing can be learned and the same strategy can be adopted in the entire electronics sector.

At the same time, ICEA Chairman Pankaj Mohindru said that this study confirms that export growth, domestic value addition, and employment generation are possible only through strategic participation in the global supply chain.

Further strategy

Stay tuned to Dynamite News for further updates.

No related posts found.