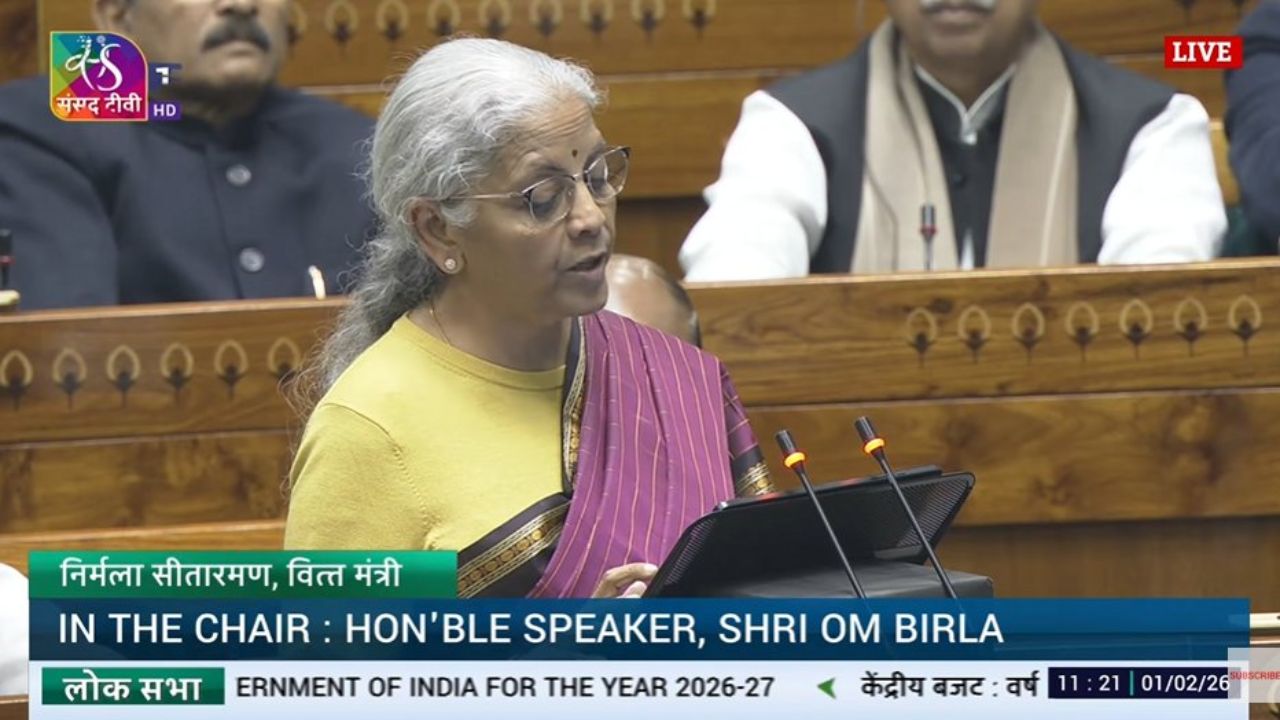

New Delhi: The Union Budget 2026-27, presented by Finance Minister Nirmala Sitharaman in Parliament on Saturday, brings a mixed bag of relief and added burden for Indian consumers. Through changes in customs duties, tariffs and taxes, the government has signalled which goods are likely to become more affordable and which could pinch household budgets in the coming year.

Relief on Imports: Items Likely to Get Cheaper

A key focus of Budget 2026 is reducing costs on essential and growth-linked sectors. Several imported goods are expected to become cheaper due to lower customs duties.

Healthcare sees major relief, with 17 cancer-related drugs exempted from customs duty. In addition, medicines, drugs and food for special medical purposes meant for seven rare diseases have been granted duty concessions, easing financial pressure on patients and families.

Budget 2026 focuses on infrastructure, MSMEs; No tax relief for middle class

Consumers may also see lower prices on leather footwear, textile garments and seafood products. Travel-related expenses could reduce slightly, as overseas tour packages and foreign education services are expected to benefit from revised duty structures.

In line with India’s clean energy push, lithium-ion cells, solar glass, biogas-blended CNG and critical minerals used in renewable technologies have been made cheaper. Components used in aircraft manufacturing and microwave ovens have also received duty relief, which could support domestic manufacturing and eventually benefit consumers.

Budget 2026-27: What's got cheaper?

- Personal use imported goods

- 17 drugs or medicines for cancer patients

- Drugs, medicines and Food for Special Medical Purposes (FSMP) for 7 rare diseases

- Leather items (footwear)

- Textile garments

- Seafood products

- Overseas tour package

- Lithium-Ion Cells for batteries

- Solar glass

- Critical minerals

- Biogas-blended CNG

- Aircraft manufacturing components

- Microwave oven

- Foreign education

Budget 2026-27: What's got costlier?

A list of items expected to get costlier:

- Alcohol

- Cigarettes

- Nuclear Power Projects components

- Minerals, iron ore, coal

- Misreporting of income tax

- Stock options and future trading

‘Blind to India’s real crises’: Rahul Gandhi slams Budget 2026-27 over jobs, farm distress

Higher Sin Taxes and Investment Costs

On the flip side, the Budget proposes higher levies on certain goods and financial activities. Alcohol and cigarettes are set to become more expensive, as the government continues to use taxation to curb consumption of harmful products.

Costs related to stock market trading are also expected to rise, following an increase in Securities Transaction Tax (STT) on futures and options. Misreporting of income tax will attract stiffer penalties, signalling tighter compliance norms.

Additionally, minerals such as iron ore and coal, along with components used in nuclear power projects, are expected to see higher costs due to revised duty structures.