English

English

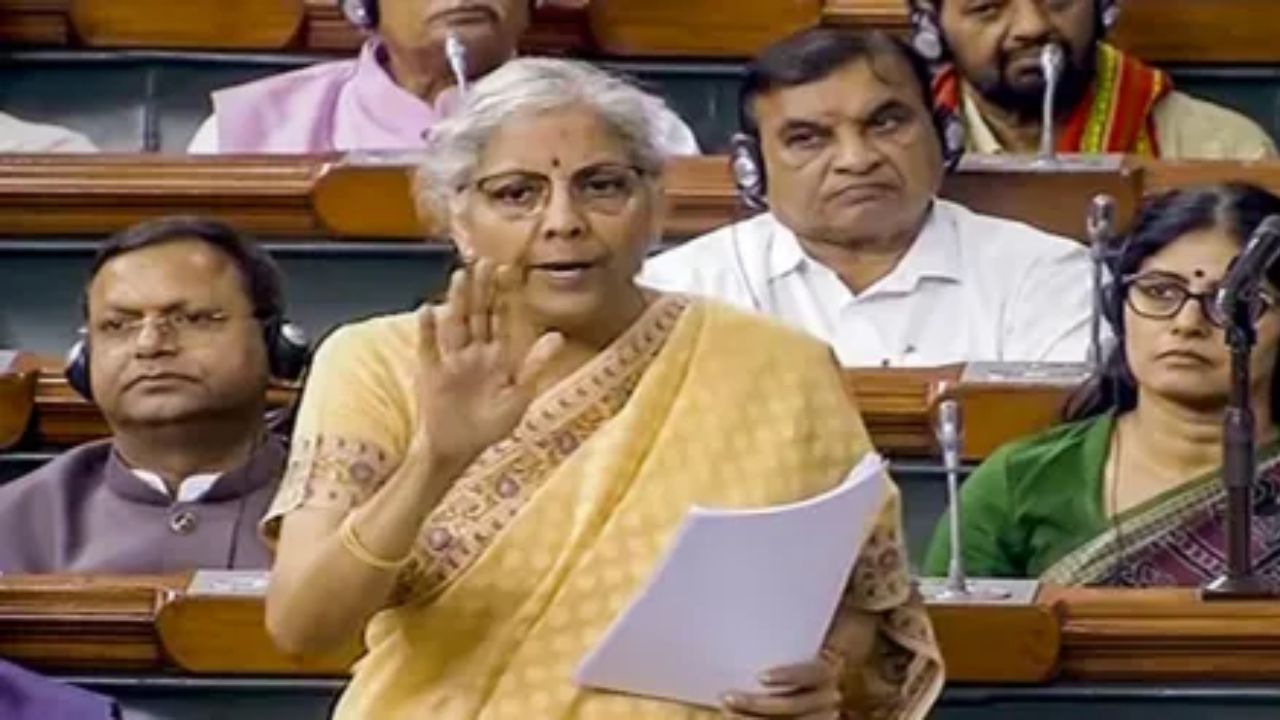

Union Finance Minister Nirmala Sitharaman presented the new Income Tax Bill 2025 to Parliament, replacing the 1961 Income Tax Act. The bill was withdrawn due to the House’s adjournment, and the government made modifications based on committee recommendations. The new bill is expected to be entirely different from the previous one, which caused confusion. The draft Income Tax Bill incorporates the recommendations made by the Select Committee on 21 July, such as drafting cross-referencing and simplifying the laws wording.

New Income Tax Bill 2025 introduced in Parliament

New Delhi: Today the new Income Tax Bill 2025 presented to Parliament by Union Finance Minister Nirmala Sitharaman. The Lok Sabha received the bill last week. However, the Lok Sabha was adjourned. Today (11 August) the Finance Minister has again tabled the bill in the Lok Sabha.

The 1961 Income Tax Act will be replaced by the new bill. Due to the Houses adjournment the Finance Minister had to withdraw the bill that had been introduced earlier Friday.

The Income Tax Bill was reintroduced in the House today after the government made some modifications based on committee recommendations after withdrawing it, Minister of Parliamentary Affairs Kiren Rijiju said.

It is likely that the income tax bill will now be entirely different. It has taken a lot of effort. The new bill will be entirely different from the previous one.

As the head of the Lok Sabha Select Committee BJP leader Baijayant Panda has made 285 recommendations in the Income Tax Bill all of which the government has approved.

A new version of the income tax bill has been introduced because the previous one caused a lot of confusion. The committee had offered suggestions.

We would like to inform you that the draft income tax bill incorporates the recommendations made by the Select Committee on 21 July. Some examples of these include drafting cross-referencing and simplifying the laws wording. The panel had recommended several significant adjustments to the Income Tax Bill.

1. Tax Refund

The previous bill stated that there would be no refund if the income tax return was not filed by the deadline. The panel recommended that this clause be removed.

2. Inter-corporate dividends

Paying inter-corporate dividends to specific companies under Section 80M of the Income Tax Act is known as inter-corporate dividends. This clause was not in the bill that was introduced on Friday the government withdrew the bill.

3. Zero TDS Certificate

The Income Tax Bill Committee recommended that individuals making tax deposits be granted a NIL TDS Certificate.

The laws pertaining to income taxes will be updated and made simpler. The Select Committees suggestions will be taken into account. The current Income Tax Act 1961 will be made more user-friendly while maintaining its fundamental framework.

The governments action demonstrates its commitment to tax reforms and its efforts to rewrite the bill in order to eliminate any legal ambiguities. August will see the introduction of the new bill which will then be thoroughly examined in Parliament. This change is regarded as a significant step in improving the effectiveness and transparency of the nations tax system.