English

English

The 14th GST Council meet started with a minute’s silence to pay condolence to the sudden demise of Union Environment Minister Anil Madhav Dave at Sher-i-Kashmir International Conference Centre on Thursday. The meet is being attended by finance ministers of all states and union territories.

Srinagar: The 14th Goods and Services Tax (GST) Council meet started with a minute's silence to pay condolence to the sudden demise of Union Environment Minister Anil Madhav Dave at Sher-i-Kashmir International Conference Centre on Thursday.

The Ministry of Finance informed the same by posting pictures of the meet on its Twitter page.

Also read: Union Environment Minister Anil Madhav Dave passes away at 60

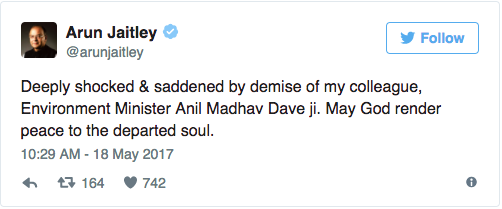

Union Finance Minister Arun Jaitley, chairing the meet, also took to Twitter to pray for the departed soul.

"Deeply shocked & saddened by demise of my colleague, Environment Minister Anil Madhav Dave ji. May God render peace to the departed soul," he tweeted.

The meet is being attended by finance ministers of all states and union territories.

It is expected that the meeting will deliberate and decide on the tax rates that will apply to various goods and services that have a bearing on the general public.

The next two days will see the council fitting most of the goods and services in the 5, 12, 18 or 28 per cent tax bracket.

The new rates fixed by the council will be charged from July 1, the scheduled date for rollout of the GST.

Also read: Madhya Pradesh to observe two-day mourning on account of Anil Dave's death

The tax rates will be decided in a fashion to keep their impact on inflation as well as revenues to the government near neutral.

The GST will be a national sales tax that will be levied on consumption of goods or use of services.

It will replace seven central taxes like excise duty and service tax and nine state taxes like VAT and entertainment tax, thereby creating India as one market with one tax rate.

The bill has already been passed in states namely, Chhattisgarh, Goa, Haryana, Madhya Pradesh, Uttarakhand and Uttar Pradesh. (with ANI Inputs)